Tax automation means standardization of tax processes/operations, including end-to-end automation where systems have the capability to provide information/data needed by different stakeholders with more ease. Let’s take an example of the tax return filing situation:

TRADITIONAL SETUP: Tax team collates the necessary data/information from ERP/other systems/teams and then uses those data to prepare the tax calculation and tax return and then submits it.

AUTOMATED SETUP: The system extracts the required data from source code, then performs the necessary tax calculation and fills the tax return – someone checks and approves the tax return and the tax return is submitted automatically to tax authorities after approval of the responsible person within the organization.

Another example, could be more of the real-time reporting which some countries have already implemented with e-invoicing systems in place (e-invoicing+ real time VAT reporting has become mandate in some of the countries). This has also helped in reducing the amount of tax fraud.

Some of the benefits of tax automation could include:

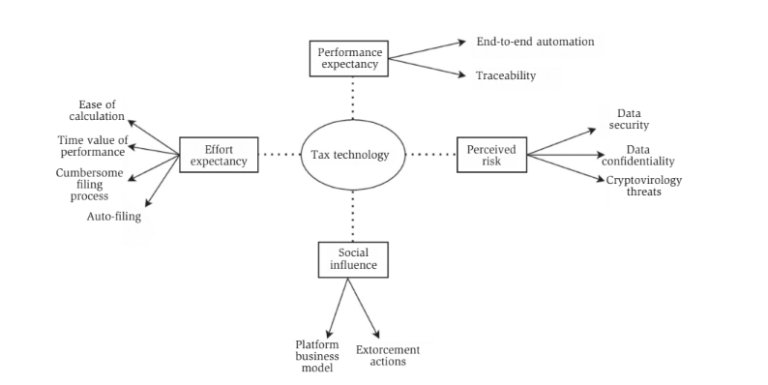

Reference can also be placed to diagram below (Effect of use of technology in taxation)

Diagram from S. Huibregtse, N. Jalan, J. Verkamman, Treating Tax-Relevant Data as a Strategic Asset by the In-House Tax Department, Chapter 4, Tax Law and Digitization How to Combine Legal Tech and Tax Tech (2022), Wolters Kluwer. Primary Source: Gangodawilage et al., Use of Technology to Manage Tax Compliance Behavior of Entrepreneurs in the Digital Economy, International Journal of Scientific and Research Publications, Volume 11, Issue 3, March 2021 366 ISSN 2250-3153.

Noticeable use of tax tech is already seen in various direct/ indirect tax compliance (especially in areas of high frequency/ quantum of transactions). Automation techniques can be applied to areas of tax provision calculations, tax returns, VAT calculations & filings, certain transfer pricing process. The use of automation in the area of Operational Transfer Pricing is also evolving.

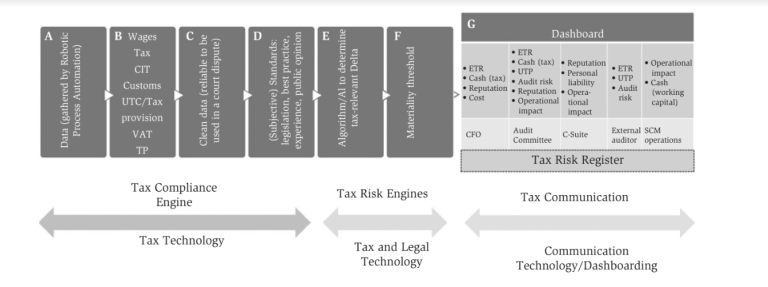

Also, it would be good to link tax tech with legal tech along with effective tax compliance tool (i.e., a system of tax compliance+ tax risk management+ tax communication). Also, combining tax tech. tools with ERP and other data mining tools with ERP would help companies to manage data requirements from different stakeholders effectively.

Diagram: Tax, legal and communication technology; Source: S. Huibregtse, N. Jalan, J. Verkamman, Treating Tax-Relevant Data as a Strategic Asset by the In-House Tax Department, Chapter 4, Tax Law and Digitization How to Combine Legal Tech and Tax Tech (2022), Wolters Kluwer

Out of the several risk/ challenges that may arise in the tax automation process, some could be:

Overall, while tax automation can provide many benefits, it is important to be aware of the potential risks and areas that may need regular checks so as to take appropriate measures to manage these risks.

There could be different reasons, but some of the comment ones could be:

Ending comment: In all, anyone looking for tax automation should choose the tax automation tools wisely (a single tool may not work for all the automation required) considering the ERP, internal processes, possible customization required and the capacity of the tool to adopt to changes (where required) in future!!

The views in all sections are personal views of the author.