Some countries are high on mineral resources but lack enough growth. With good policies, these countries may be able to exploit several opportunities to make use of adequate resources. Some of the challenges in the resource sector in general are:

The sector faces a lot of environmental concerns and regulatory issues. There have been several research in the direction of adequate taxation of the mining sector. A lot of concerns have been raised about adequate taxation measures that can be taken for these sectors. Countries are already aware of the benefits that sector brings to them in terms of employment/ local infrastructure/ linkage to other sectors/ foreign exchange earnings etc.

The two main elements of the tax revenue from the sector are mainly corporate income tax (CIT) and royalties, as shown in the diagram below:

CIT varies in the range of 20% to 40% of the net profits, while royalty payments are in the range between 2% and 6% of gross sales[1]. Some of the other variants of taxes adopted by countries in this regard are mining taxes, taxes on exports, some form of indirect taxes, Minerals Resource Rent Tax, CFEM—Compensation for the Exploitation of Mineral Resources, Special Mining Contribution, Charge for use of subsoil, Pollution tax.

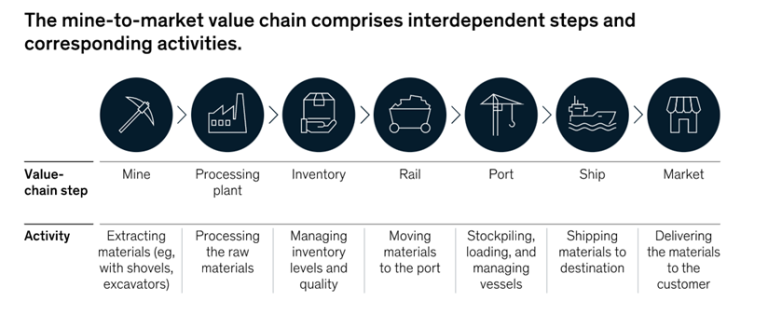

On the other hand, it is useful to have appropriate transfer pricing guidelines for benchmarking products of the sectors in cross-border situations. This will help in the appropriate allocation of profits between jurisdictions. A typical value chain of the company in the mining sector would appear as under:

Source: The mine-to-market value chain: A hidden gem, McKinsey & Company; https://www.mckinsey.com/industries/metals-and-mining/our-insights/the-mine-to-market-value-chain-a-hidden-gem

Companies may have different entities managing different parts of the value chain. In such a situation, where an entity is located cross-border, challenges arise in the profit allocations in the case of cross-border transactions. One such problem is benchmarking of commodity transactions, as discussed below:

Firstly, the meaning of the term commodity[2] is not clearly laid down in any OECD/ UN guidelines. The term should not only include goods but should also include services, as advocated by some[3]. Further, when it comes to benchmarking commodity transactions, because of its characteristics, only two methods of transfer pricing may work, i.e., the Comparable uncontrolled price (CUP) method or the sixth method. CUP in commodities transactions may be an appropriate transfer pricing method for establishing the arm’s length price for the transfer between associated enterprises of commodities for which a quoted or public price is available. Hence, various challenges arise when applying the CUP for such transactions (like availability of reference prices/quoted prices be found for all transactions/ availability of these quoted prices in the public domain, how to determine typically very low tolerance level for non-qualifiable and non-quantifiable differences?)

Transactions on commodities take place every few seconds. However, the quoted spot value is available only for limited commodities. Hence, it is difficult to find the real-time quoted price and determine an appropriate date closest to the transaction. Also, even for the commodities for which quoted, prices are available, the price varies largely in the local/ international market. Hence, it is unclear which one should be considered a proper application of the CUP method. In situations where intercompany agreements carry a price clause that relies on quoted prices, may carry weight in the application of CUP as the leading method.

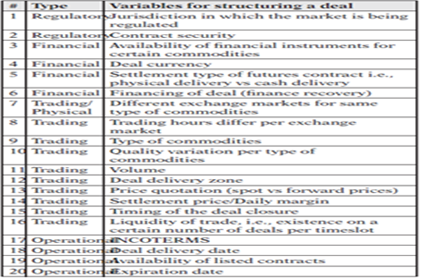

However, the use of CUP is ruled out in most cases because of various reasons such as differences in spot price and future price, variations in supply chain/ value chain etc., some of which are reflected in the diagram below:

Variables for structures for structuring a deal to the original reference price[4]

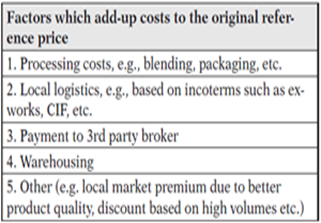

Supply chain and the factors that add up costs [5]

Several countries are using the sixth method on the reasoning that the OECD version of the sixth method allows for the use of quoted prices on other days and other valuations by MNEs and not only the international quoted prices at the shipping date etc. However, again there is no uniform system of benchmarking even in the sixth method, and country practices vary. For example: In Brazil, the application of the export quotation price (for which the Portuguese acronym is PECEX) is mandatory in the case of export of commodities made to i) related parties, ii) resident in a jurisdiction with a favourable taxation, or iii) entities that benefit from differential fiscal regimes. In Zambia, Sixth Method was introduced through the introduction of a reference price for any transactions relating to the sale of base metals, precious metals or any substance containing base metals or precious metals, directly or indirectly, between related or associated parties. The variation in practice can be on various aspects such as transactions covered, products covered, price consideration, the possibility of qualitative and quantitative adjustments etc.[6]

The use of a different variant of the sixth method cannot reflect the multiple variables that define the ‘value drivers’ of the industry and specific deals. Further, OECD transfer pricing guidelines do not provide much clarity on the subject.

Thus, the solution to this issue may lie in finding a consistent definition of the term commodity and laying down a unified approach that can be adopted by benchmarking such transactions where quoted price is not available. The unified approach should be framed considering the value chain/ supply chain. Blockchain technology can be used to appropriately capture the value chain. Blockchain can be used to validate the workflow/audit of activities. Further, smart contracts can be used for contracts to avoid chances of manipulation and have proper control over agreements.

[1] The Future of Resource Taxation: A Roadmap, IGF (2020); available at https://www.iisd.org/system/files/2020-10/future-resource-taxation-roadmap.pdf

[2] Commodities include mining products

[3] Commodity Exchange Act (USA), L.E. Schoueri, Preços de Transferência no Direito Tributário Brasileiro, 3rd edn. (Dialética 2013).

[4] Katerina Miari and Steef Huibregtse, Top Transfer Pricing Challenges for the Agri-commodities Industry (October 2016)

[5] ibid

[6] Verónica Grondona, Concepts and practices of the ‘Sixth Method’ in Transfer Pricing (2019); available at https://taxinitiative.southcentre.int//home/u176728480/domains/nupurjalan.com/public_html/wp-content/uploads/2019/12/GrondonaMethod6.pdf

The views in all sections are personal views of the author.