In part 5 of the series, I have discussed Article 24(4) which deals with deduction non-discrimination in detail. In this part, I will discuss Article 24(5) which deals with ownership based non-discrimination and Article 24(6)

This paragraph prohibits a contracting State to give less favorable treatment to an enterprise, the capital of which is owned or controlled, wholly or partly, directly or indirectly, by one or more residents of the other contracting State.

For ex. – Enterprise in State ‘A’ which is wholly or partly owned or controlled, directly or indirectly by residents of State ‘B’ should not be subjected in State ‘A’ to any taxation or connected requirement which is other or more burdensome than taxation or connected requirement to which another Enterprise in State ‘A’, in the same circumstance, is subjected to.

Hence, the purpose of this clause is to safeguard equal treatment to an enterprise in State A which is discriminated solely on account of foreign ownership.

Article 24(5) of the OECD and UN model is reproduced below –

Conditions to be satisfied –

Pertinent to note, that the object of comparison in this clause is ‘similar enterprise’. Reference in this regard can be drawn from OCED Discussion Draft (2007) on Application and Interpretation of Article 24 para 88, which reads as under –

‘ 88. The Working Group reached the conclusion that the right comparator for the purposes of paragraph 5 was a domestic enterprise owned by residents but agreed that there was no need to clarify this issue in the Commentary as long as there was no practical reason to do so. ‘

Illustrative list of situations in which Clause 24(5) cannot be invoked –

Indian Judicial Pronouncements –

Ruling in brief – In this case, by invoking article 24(4) of the India-Germany tax treaty, Tribunal held that the Indian subsidiary of the German company, shares of which are listed on the German stock exchange is to be treated as ‘company in which public is substantially interested’ under section 2(18) of the India Income-tax Act. The reason for this was that an Indian company having a foreign parent company should not be discriminated with an Indian company having Indian parent company shares which are listed on the India stock exchange.

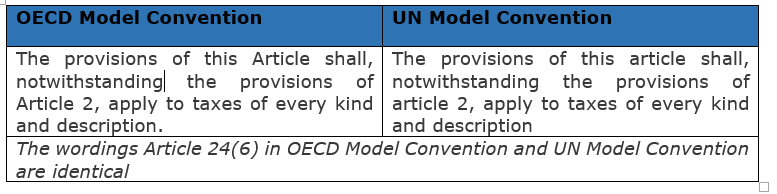

Article 24(6) of the Model Convention reads as under –

This means that Article 24 is applicable to taxes of every kind and description notwithstanding the provisions of Article 2 of the convention.

Further, this clause does not appear in all the DTAAs entered into by India, except for a few like South Korea, Australia, Portugal, etc. Generally, the wordings found in Indian DTAA are –

‘ the term “taxation” means taxes which are the subject of this Convention’

The views in all sections are personal views of the author.