In Part 2, I have discussed PE triangular case. In this part, I am focusing on the second situation i.e. Reverse PE triangular case.

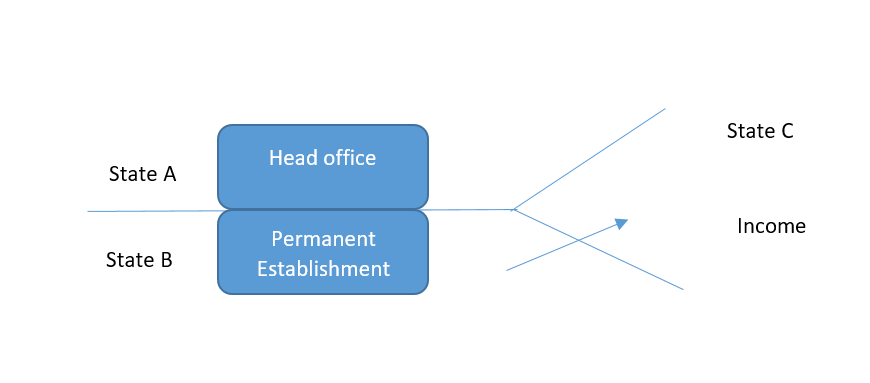

In a reverse PE triangular case, both the head office state (State A) and the PE state (State B) of the payer may seek to impose source-based taxation on the payment made to the resident of the third state. Example – Let’s presume that the head office (State A) and pays interest to the resident of State C on a loan that can be attributed to the PE in State B (i.e. income originates from PE in State B). The same is illustrated below –

For example – If the tax treaty between State A and State C provides for source state taxation on interest at the rate of 10% while the tax treaty between State B and C only allows taxation of up to 5% of the gross amount of the interest, how interest will be taxed in State A, State B, and State C.

Tax treaties between States A and C and between States B and C provide State C has the unrestricted right to tax interest sourced in State A or State B. Also, State C is obliged to grant a foreign tax credit for the tax paid in the source state. The question that arises is therefore, which state should be considered as the source state (i.e. State A or State B) regarding the interest payment as both States A and B are entitled to levy tax on the interest payment.

Further, if the “interest” article in the State B and State C tax treaty contains a sourcing rule similar to Art. 11(5) of the OECD Model Tax Convention, under the second sentence, State B should be regarded as the source state. This means that in State B the interest payment may be subjected to a withholding tax of 5% of the gross amount of the interest.

If the “interest” article of the A-C tax treaty is similar to Art. 11 of the OECD Model Tax Convention, the first sentence of the sourcing rule of Art. 11(5) would deem State A to be the source state of the interest. The second sentence of this provision does not alter this since the PE is not in State A or State C and State B is not a signatory to the tax treaty. The State A and State C tax treaty, therefore allows State A to levy tax at a rate of 10% of the gross amount of the interest.

To resolve reverse PE triangular cases, either State B or State A should be prevented from imposing source-based taxation. Of these two states, it seems more appropriate to prevent taxation in State A, since the interest must have a significant economic connection to the activities of the PE (and thus the PE state) in order to be borne by the PE.

Another way of preventing State A from imposing tax in reverse PE triangular cases is by altering the wording of Article 11(5) in the tax treaty between State A and State C to the effect that interest that is connected with a PE would be considered to arise in the PE state (State B) even if the PE state is not one of the contracting states to the tax treaty. As a result, the interest would not be considered to arise in State A for the purposes of applying the State A and State C tax treaty, and thus the distributive rule of Article 11 would not apply.

The views in all sections are personal views of the author.