The write-up mainly covers basics of cryptocurrency/NFTs and a broader overview of some tax considerations surrounding them.

Since, most of the crypto assets are based on blockchain technology, let’s briefly understand what blockchain is:

In simple terms, blockchain is a database of ledgers spread over computers in the blockchain network and is not managed by any central authority.

Now, let’s understand what is cryptocurrency?

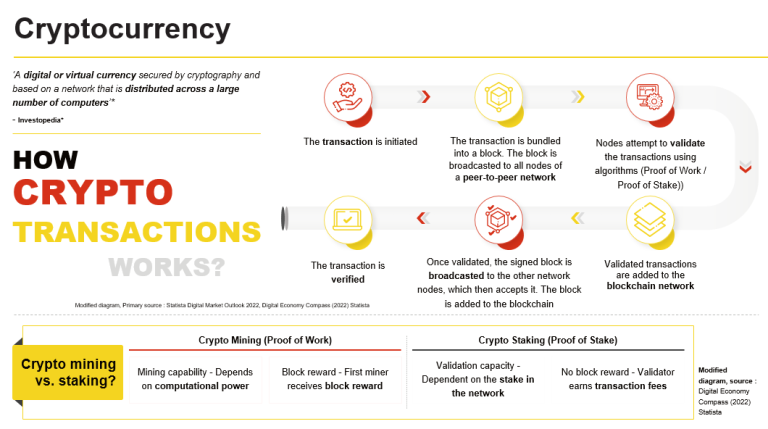

Let’s say A wants to send cryptocurrency to B. A will initiate the transaction. The transaction will then be broadcasted in the peer-to-peer network. The transaction will then be validated via consensus mechanism (this will involve ensuring that there is sufficient cryptocurrency in A’s wallet). There are many consensus mechanisms, but the prominent ones used for cryptocurrency are Proof of Work & Proof of Stake.

Proof of Work also known as crypto mining entails solving the complex mathematical puzzles by the miner. The mining capability depends on the computation power of the miner and the first miner to solve the complex mathematical puzzle is rewarded with the cryptocurrency. While in Proof of Stake often referred to as crypto staking, people have to stake their cryptocurrency in blockchain networks to get selected for validation purposes. The person who puts more cryptocurrency at stake has a higher chance of selection for validating the transaction. The validator here earns transaction fees and not cryptocurrency as rewards.

Once the transaction is verified the transaction is added to the blockchain network in the form of a new block. And the cryptocurrency will then be transferred from A’s wallet to B’s wallet.

Also, there can different forms of cryptocurrencies having different used cases, some of them are mentioned below:

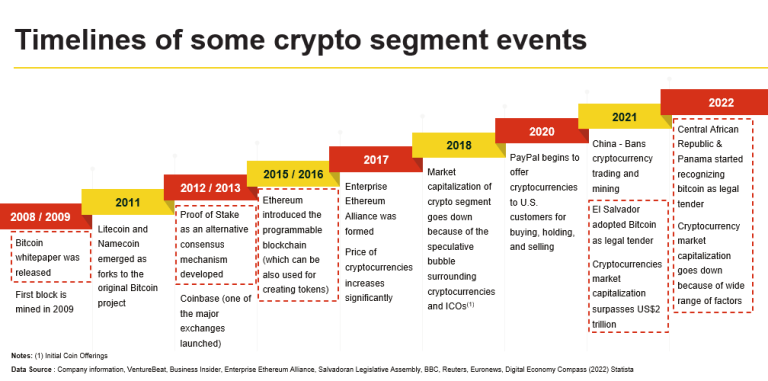

The below diagram mainly shows some of the critical events that happened in the crypto space over the last years.

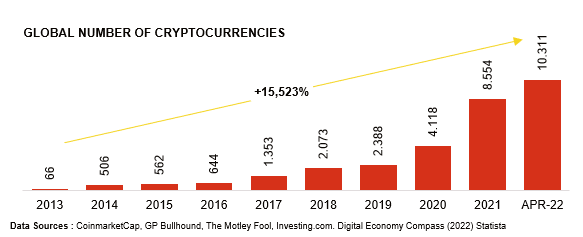

The below diagrams represents some statistics around cryptocurrencies.

The above diagram reflects the growth in the global number of cryptocurrency in circulation.

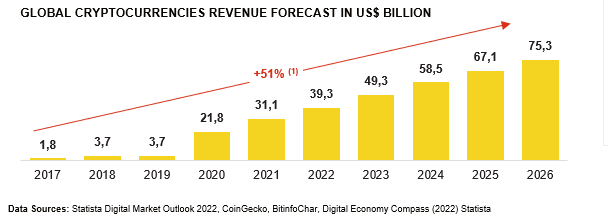

The above diagram shows the global revenue forecast from cryptocurrencies. Major pick happened in 2020 and it is expected to only grow in the coming years.

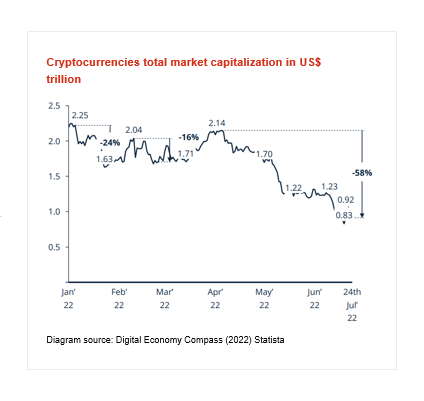

The above diagram represents that the market capitalisation of the cryptocurrencies is going down from the last few months. This could be because of range of factors (for ex. – currently, the global market itself is not performing well). We have to wait and watch to see where it goes in the coming months.

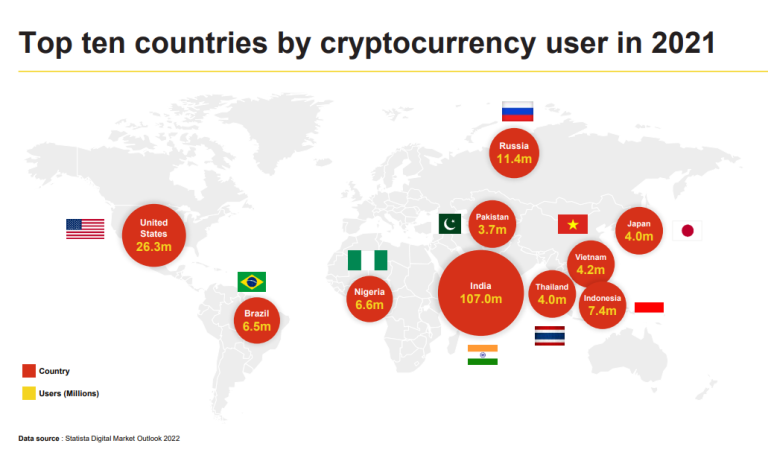

The diagram below reflects top ten countries based on the cryptocurrency user base:

Coming to the tax considerations around virtual currencies/ cryptocurrencies:

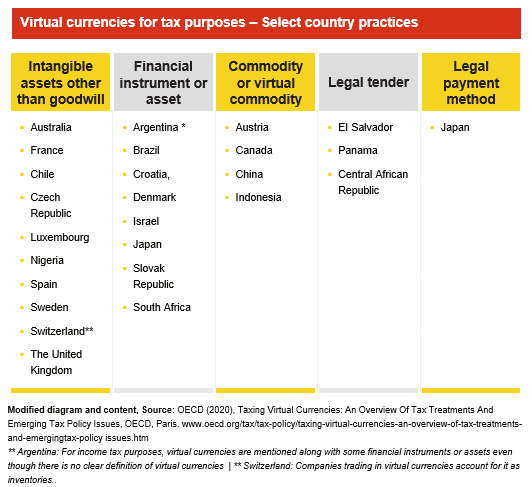

There is no uniform characterisation of cryptocurrencies across currencies. The table below reflects the diverse practice among countries for characterisation of cryptocurrencies for tax purposes:

Separately, even for countries that have laid down some guidelines, policies for taxable events in relation to these currencies vary, as shown in the diagram below:

Furthermore, the taxation regime and the head under which countries tax these also varies. Some country laws are covered briefly below:

![]()

Japan: Crypto gains are considered miscellaneous income. Tax rates on crypto gains vary – rates can be high up to 55%.

South Korea: Virtual assets are categorized under other income for income tax purposes. Gains will be taxed at a rate of 20%.

New Zealand: Cryptos are treated as properties for income tax purposes. Tax treatment depends on the characteristic and use.

Australia: Cryptocurrency are subject to capital gain tax in Australia in the range from 19 to 45%.

Austria: Crypto holdings will be counted as income from capital assets and are taxed at the special rate of 27.5%.

France: Cryptos are taxed similar to movable property. Occasional traders are charged a flat tax of 30% while miners and professional traders are taxed at 45%.

Ireland: Ordinary tax rules apply – profits and losses from cryptocurrency transactions are taxable as normal income.

Netherlands: Taxes on capital gains are not imposed, but a deemed interest on the value of all assets minus all liabilities is imposed. The deemed interest is taxable against a flat rate of 31% (in 2021, 30% in 2020).

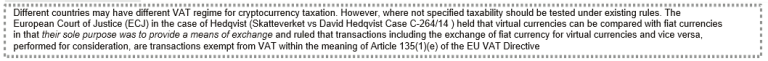

From indirect tax perspective:

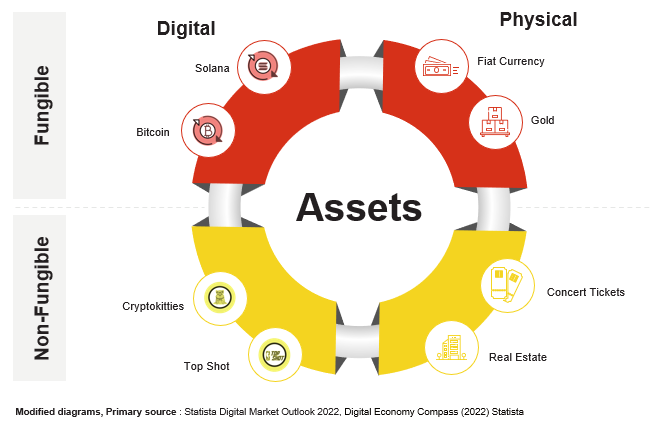

It is called non-fungible because they are unique. For ex.: one euro will always be equal to one euro/ one unit of bitcoin will be equal to one unit of bitcoin. However, say one piece of art may not be the same as another piece of art.

NFT’s are unique tokens which depict the nature of ownership rights the person has over the underlying asset. Mainly, NFTs are digital files having a unique identity that is verified on a blockchain (i.e., it is a unique cryptographic asset that exists on a blockchain)

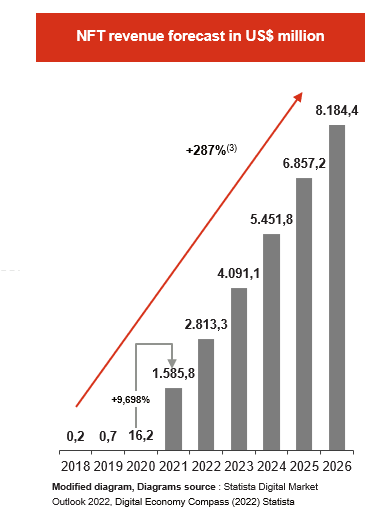

The diagram below shows how the NFT market has substantially progressed in 2021 and is expected to only rise in the coming years.

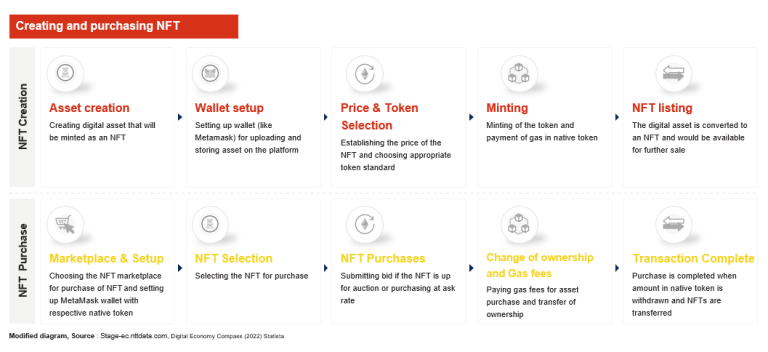

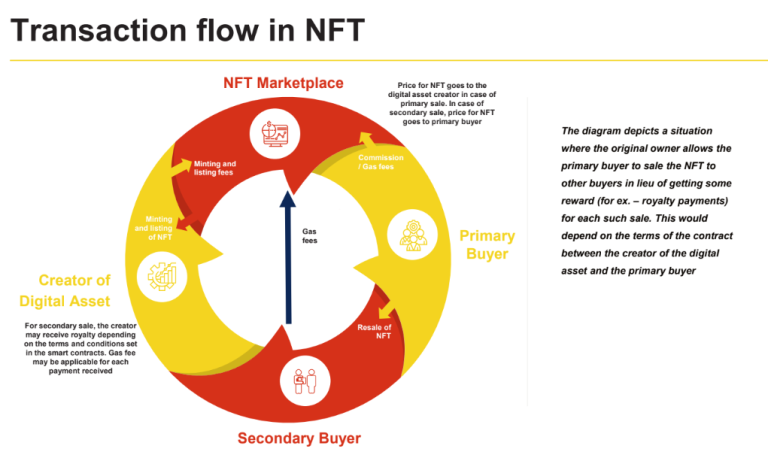

The below diagram shows the mechanism/ steps of creation and purchase of NFT’s:

The diagram below shows the timeline of some of the events that happened in the NFT space. The major pick happened in 2021 with some of the most discussed and high worth NFT transactions happening in this year. Then, more and more companies started joining metaverse/ NFTs wave.

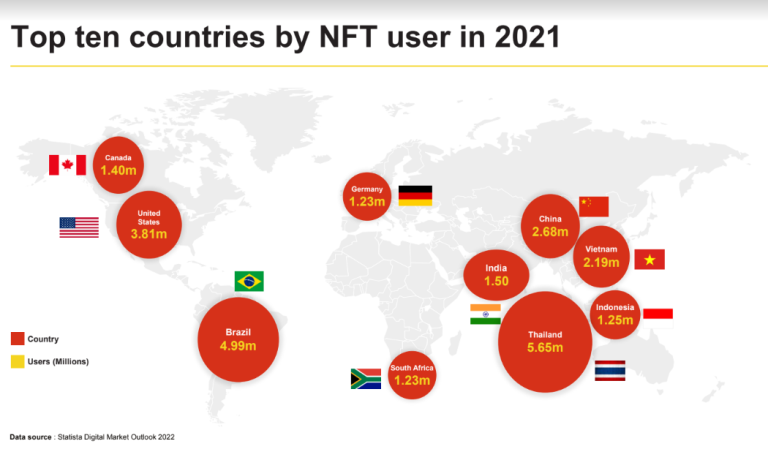

The diagram below reflects the top ten countries based on the NFT user base in 2021:

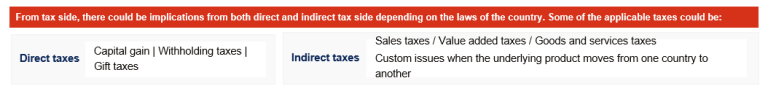

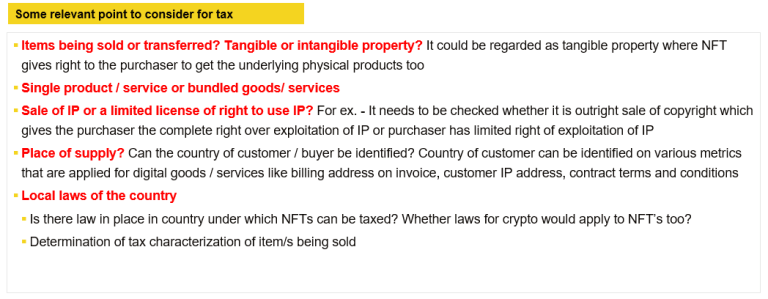

In relation to NFTs and taxes, there could be multiple tax issues, some of which have been covered below:

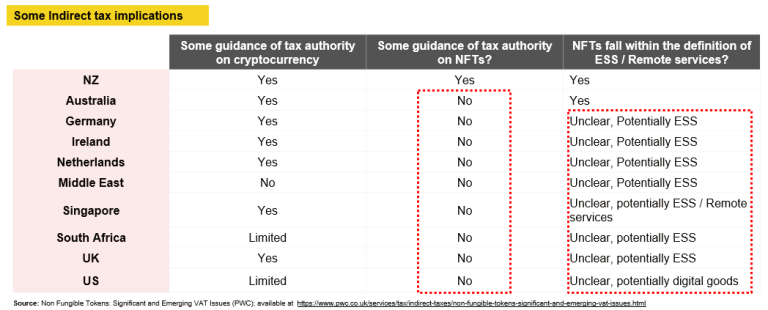

The below diagram (covering mainly the indirect tax implications) reflects that many countries have not clearly specified how NFTs can be taxed.

VAT implication on non-fungible tokens may not be the same as that of cryptocurrency. In Spain ruling V0482-22, of March 10, 2022, issued by the Spanish General Directorate of Taxes (Dirección General de Tributos), Transfer of NFTs was regarded as ‘supply of services’. Per the ruling, VAT was accorded similar treatment as that of ‘electronically supplied goods.

Similarly, laws surrounding direct taxes are not clear for NFTs. Some countries, though, have laid down a direct tax mechanism around NFTs. For ex.: India has included NFTs in the definition of Virtual Digital Assets for the purposes of the direct taxes.

The views in all sections are personal views of the author.